Mobile Banking

UBA Mobile Banking App is an electronic banking product that allows customers to access their bank account via their mobile phones.

Discover the freedom of Mobile Banking

This product is internet dependent and requires customers to have smart devices (phones & tablets). The app is available on App Store and Google Play Store. It enables subscribers carryout basic banking services anywhere in the world as long as the customer has access to data.

Benefits

- Secure platform for interacting with the bank without recourse to physical presence

- Self-initiated transactions such as transfer, balance enquiries, mini statement downloads, payments, airtime purchase, etc.

- Easy access to transaction history

Biometric Authentication

Improved User Experience

Realtime Transaction History

Keep an eye on cash inflows and outflows so you know what is going and where.

We're Always Here to Help

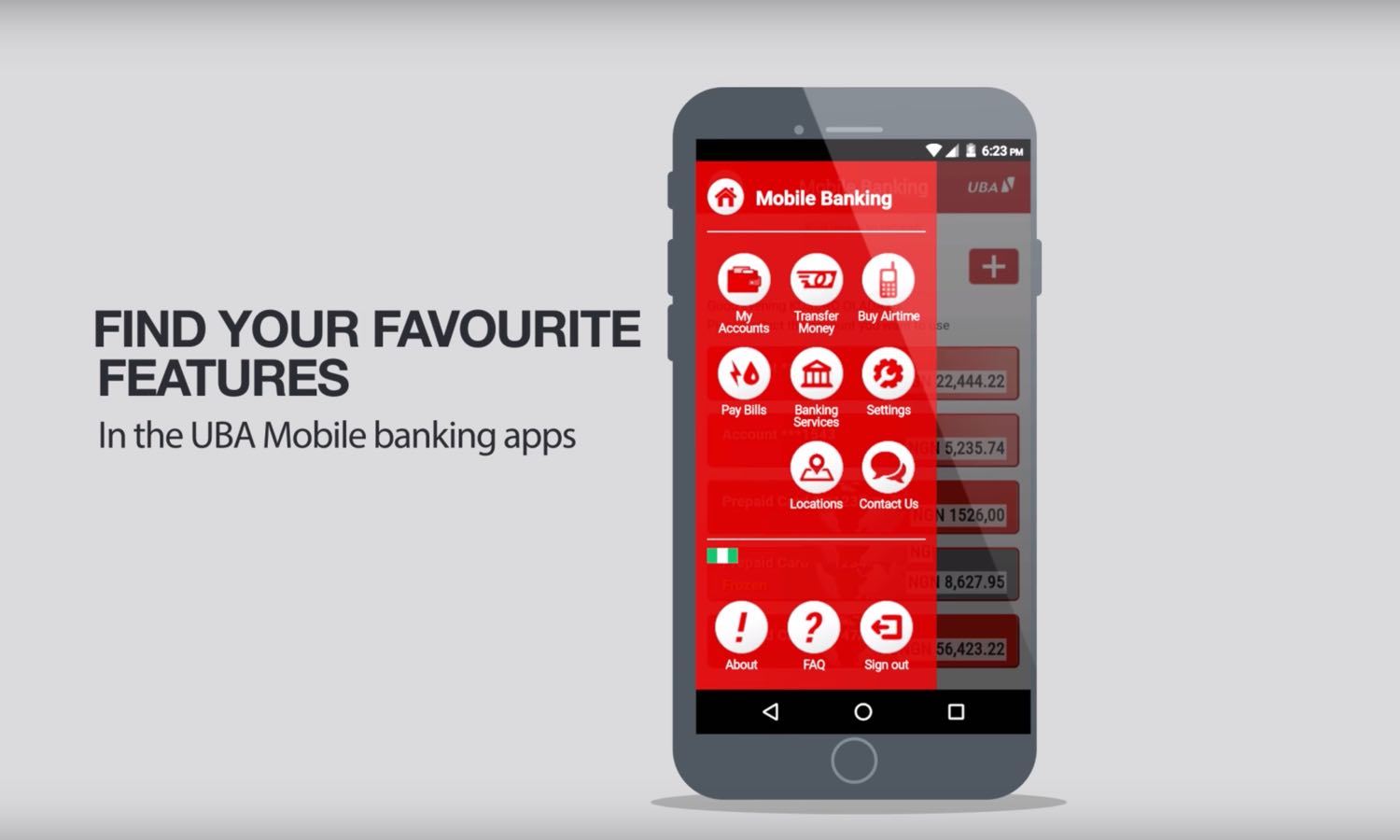

Features

- Self-enrolment

- Access recent transactions

- Statement View

- Transfer money between accounts

- Transfer money to any mobile phone in real-time

- Top-up your mobile phone

- Multiple device setup (Up to 3 devices)

- App personalisation (Profile Picture, Wall Paper)

Make Banking a Brand New Experience

We never stop looking for new ways to make banking simpler, smarter and better.

UBA Mobile Banking Service gives you unrestricted and secure access to your account, anytime, anywhere; tablet, smartphone or any mobile device. Welcome to banking on the go!

All the Basics, Covered

Put it in your pocket

Put it in your pocket

Download the UBA Mobile app today and access your money anytime you need it.

Our Mobile Banking App lets you carry your bank with you wherever you go. You can perform transactions and manage your bank account(s) from your mobile device.

Pay Bills

Pay Bills

Settle your bills from the comfort of your fingertips. Pay for internet services, utilities, school fees, investments and insurance, tax, transport and toll payments, mobile money, and so much more.

Move Money

Move Money

Quickly transfer money either within your own UBA accounts, other UBA accounts or to accounts of other banks.

See Transactions

See Transactions

Easily find transactions using transaction history feature. Keep an eye on cash inflows and outflows so you know what is going and where.

Mobile Banking Application

UBA is providing a completely enhanced mobile banking experience to its customers with this new app. Banking services are easily accessible and on-the-go through new features such as:

- Quick Log-in

- ATM/Branch Locator

- Balance inquiry

- Screens enhancing user-experience

- 24-hour support

- Faster navigation with sliding menu

- Automation of OTP

- Auto reminders

FAQs

For additional enquiries, please contact our 24/7 Customer Fulfillment Centre via cfc@ubagroup.com, 234-700 2255-822, 234-1-2808-822 or Live Chat available on the log-in screen of the app

If you are out of data or in a weak internet region, you can still use our magic banking code *822# to transact. Simply dial *822# and follow the prompt. Please note that the same PIN used for your UBA Mobile Banking will be used for UBA Magic Banking.

To do this, click on New Mobile Banking Customer? tab. You will have the following options to sign up using:

- UBA Debit Card

- UBA Prepaid Card

- UBA Account + Secure Pass

Note: If you already have a Secure Pass (token) for UBA Internet Banking, it can be used here - Continue Branch SignUp

Note: For Branch sign up, visit any UBA Business Office.

When you change your device and/or download a new app, your profile may become temporarily inactive. This is to prevent unauthorised access to your account. You may be prompted to be re-registered on the new device, simply proceed with the instructions.

If you forget your password, the app will prompt you to reset your password. You can also use the Having trouble entering the App? tab on the log-in screen

You can change your PIN by clicking on Change PIN under the Setting menu (after login)

- Download UBA Secure Pass from the apps store

- Activate the app, set your PIN and you are good to go!

For self-administration on UBA Secure Pass, click here

Note:

a. You may need may need to visit a UBA Business Office if you are prompted that “The user you specified is not eligible for One-Time Password (OTP) login”

b. The same secure pass can be used for both UBA Direct Banking and Mobile Banking

For higher limits you will need to visit any of our Business Offices or contact CFC to execute an indemnity. Please note that these limits are as regulated by the Bank of Ghana.

Yes, when doing your transactions, there is a tab for save to favorites list to add your favourites. You can then be selecting from your favourite list in subsequent transactions.

Note: Your favourite can be edited/deleted from settings, by sliding the favourite to the left.

After you log in to the app, select the account or card you would like to view and click on Statement to display your transactions. You will be able to view your last 6 months statement.

You can check the location of the nearest UBA ATMs and know if the ATMs are active (i.e. dispensing cash) or inac tive (not dispensing cash). You also can take a tour to know what you can do with the mobile app and contact our 24/7 CFC via phone, email or Live Chat